Maximizing Returns: Unveiling The Ultimate Bond Investment Strategies For 2022!

Bond Investment Strategies 2022: Maximizing Returns in a Challenging Market

Introduction

Dear Readers,

1 Picture Gallery: Maximizing Returns: Unveiling The Ultimate Bond Investment Strategies For 2022!

Welcome to our comprehensive guide on bond investment strategies for 2022. In the midst of an ever-evolving market, it is crucial for investors to stay informed and adapt their strategies accordingly. With a myriad of options available, understanding the ins and outs of bond investments is essential to maximize returns and mitigate risks.

Image Source: wpengine.com

In this article, we will delve into the world of bond investment strategies, providing you with valuable insights and practical advice. Whether you are a seasoned investor or new to the bond market, this guide aims to equip you with the knowledge and tools necessary to make informed decisions.

So, let’s dive in and explore the various aspects of bond investment strategies for 2022.

Table of Contents

Introduction

What is a bond?

Who can invest in bonds?

When is the right time to invest in bonds?

Where can one find bond investment opportunities?

Why choose bond investments?

How to develop a successful bond investment strategy?

Advantages of bond investments

Disadvantages of bond investments

FAQs

Conclusion

Final Remarks

What is a bond?

📚 Bonds are debt securities issued by governments, municipalities, and corporations as a means of raising capital. They are essentially IOUs, where the issuer promises to repay the bondholder the principal amount plus interest over a specified period of time.

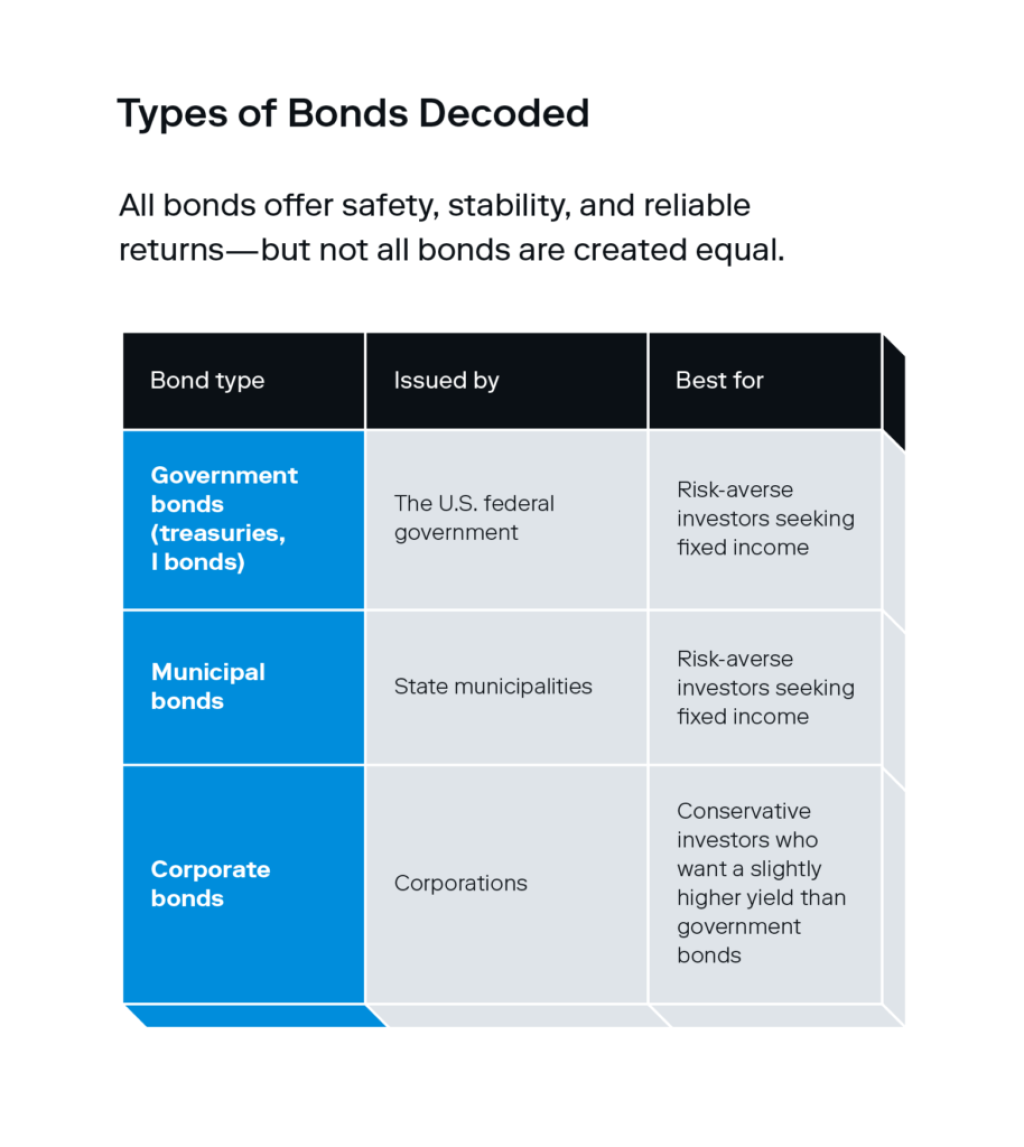

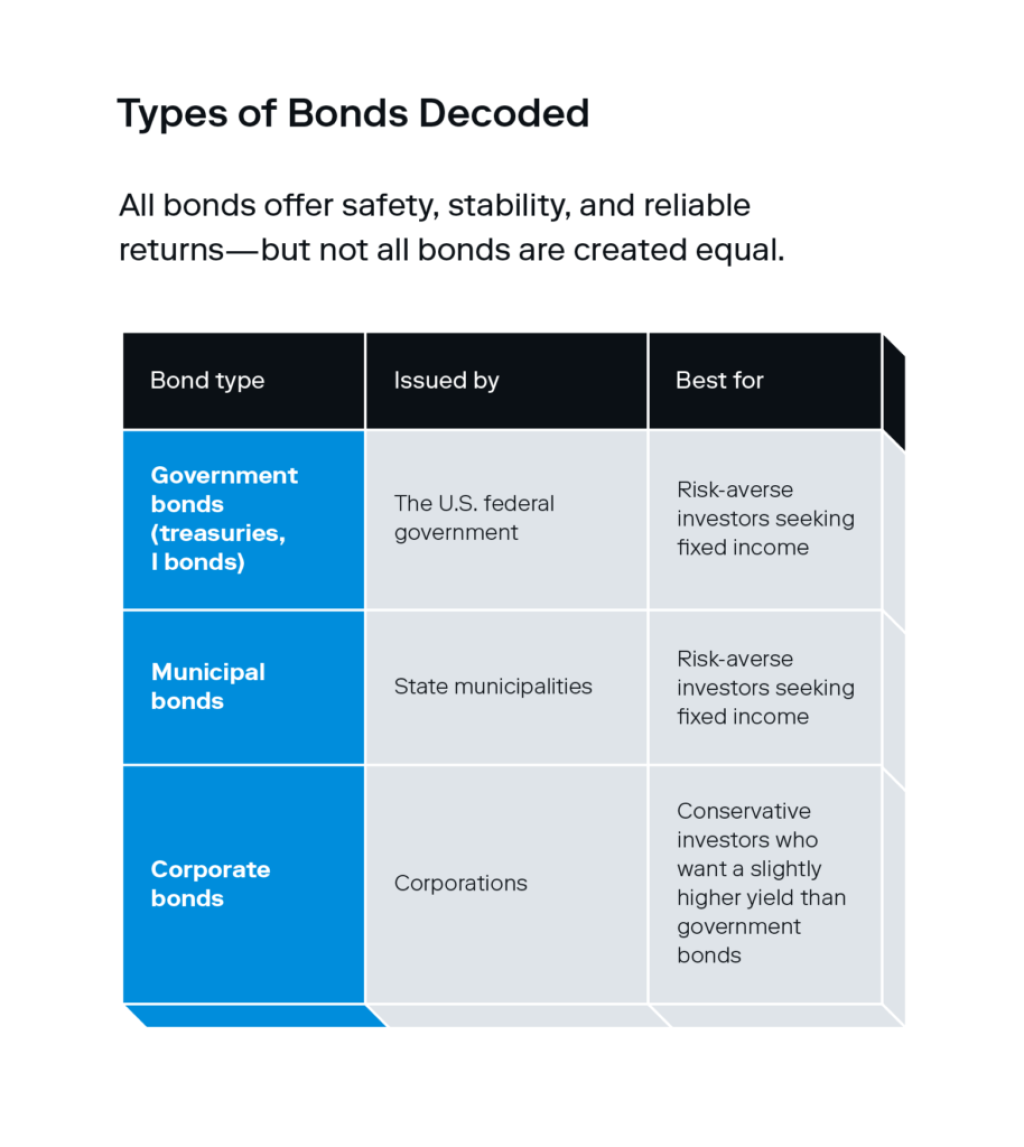

📚 Bonds are considered relatively safer investments compared to stocks, as they offer a fixed income and are generally less volatile. They are classified into various types based on their characteristics, such as government bonds, corporate bonds, municipal bonds, and more.

📚 The key components of a bond include the face value, coupon rate, maturity date, and yield. Understanding these elements is crucial for making informed investment decisions.

📚 Now that we have a basic understanding of bonds, let’s explore who can invest in them.

Who can invest in bonds?

📚 Bonds are accessible to a wide range of investors, including individuals, institutions, and even governments. They offer diversification benefits and can be suitable for both conservative and aggressive investors.

📚 Individual investors can access bonds through various channels, including brokerage firms, banks, and online platforms. Institutions, such as pension funds and insurance companies, also play a significant role in the bond market.

📚 It is important to consider factors such as risk tolerance, investment goals, and time horizon when deciding to invest in bonds. The next section will provide insights into the right timing for bond investments.

When is the right time to invest in bonds?

📚 Timing plays a crucial role in bond investments. Economic conditions, interest rates, and market trends can significantly impact the performance of bonds. As an investor, it is essential to monitor these factors and identify opportune moments to enter or exit the bond market.

📚 Generally, when interest rates are expected to decline, bond prices tend to rise, making it an attractive time to invest. Conversely, when interest rates are expected to rise, bond prices may fall, posing potential risks to investors.

📚 It is advisable to conduct thorough research, analyze economic indicators, and consult with financial advisors to make informed decisions regarding the timing of bond investments. The following section will shed light on where one can find bond investment opportunities.

Where can one find bond investment opportunities?

📚 Bond investment opportunities can be found in various markets and platforms. Government bonds are often available through official government agencies or central banks. Corporate bonds can be obtained through underwriters or financial institutions.

📚 Online platforms and brokerage firms provide easy access to a wide range of bonds, allowing individual investors to browse through different offerings and choose the ones that align with their investment goals.

📚 It is essential to conduct thorough due diligence, assess credit ratings, and consider the issuer’s financial stability before investing in bonds. Now, let’s explore the reasons why bond investments are a popular choice among investors.

Why choose bond investments?

📚 Bond investments offer several advantages that make them attractive to investors:

Steady Income: Bonds provide a fixed income stream in the form of coupon payments, making them suitable for investors seeking regular cash flow.

Capital Preservation: High-quality bonds are generally considered less risky compared to stocks, offering capital preservation benefits.

Diversification: Including bonds in an investment portfolio can help diversify risk and reduce overall volatility.

Tax Benefits: Certain bonds, such as municipal bonds, offer tax advantages, making them appealing to investors in higher tax brackets.

Accessibility: Bonds are available in various denominations, making them accessible to investors with different budgets.

📚 While bond investments have their merits, it is important to consider the potential drawbacks as well. Let’s explore the disadvantages of bond investments in the next section.

Disadvantages of bond investments

📚 Bond investments also come with a set of disadvantages that investors should be aware of:

Interest Rate Risk: Bond prices are inversely related to interest rates. When rates rise, bond prices may fall, resulting in potential capital losses.

Inflation Risk: If inflation outpaces the bond’s yield, the investor’s purchasing power may erode over time.

Credit Risk: Bonds issued by entities with lower credit ratings carry a higher risk of default, potentially leading to loss of principal.

Liquidity Risk: Some bonds may be less liquid, meaning they may be challenging to sell at desired prices.

Opportunity Cost: Investing in bonds may limit potential returns compared to riskier assets, such as stocks.

📚 It is crucial to carefully consider these factors and assess risk tolerance before diving into bond investments. Now, let’s address some frequently asked questions related to bond investment strategies.

FAQs

Can bond investments provide higher returns than stocks?

📚 While bonds generally offer more stable returns, stocks have the potential to deliver higher long-term returns. It ultimately depends on the investor’s risk appetite and investment goals.

How can I mitigate interest rate risk?

📚 Diversifying bond investments, considering bonds with different maturities, and staying updated on interest rate trends can help mitigate interest rate risk.

What is the impact of credit ratings on bond investments?

📚 Bonds with higher credit ratings are generally considered less risky. However, they may offer lower yields compared to bonds with lower ratings.

Should I invest in government or corporate bonds?

📚 Government bonds are typically seen as safer investments, while corporate bonds may offer higher yields. The choice depends on the investor’s risk tolerance and income requirements.

Do bond investments require active management?

📚 Bond investments can be managed actively or passively. Active management involves regular monitoring and adjustments, while passive management follows a predetermined strategy.

Conclusion

📚 In conclusion, bond investment strategies for 2022 require careful consideration and adaptability. Understanding the intricacies of bonds, monitoring economic conditions, and assessing risk factors are key to maximizing returns and achieving investment goals.

📚 By leveraging the advantages of bond investments while mitigating the associated risks, investors can build resilient portfolios. It is essential to conduct thorough research, seek professional advice when needed, and stay informed about market trends.

📚 We hope this comprehensive guide has provided valuable insights and empowered you to navigate the complexities of bond investment strategies. Remember, knowledge is power in the world of investing.

📚 Best of luck on your investment journey!

Final Remarks

📚 The information in this article is for educational purposes only and should not be construed as financial advice. Investing in bonds carries inherent risks, and it is crucial to conduct thorough research and seek professional guidance before making any investment decisions.

📚 The bond market is subject to fluctuations and unpredictable circumstances, which may impact the performance of bond investments. Past performance is not indicative of future results, and the value of investments can fluctuate.

📚 It is advisable to have a diversified investment portfolio that aligns with your risk tolerance and investment goals. Consult with a financial advisor or investment professional to determine the most suitable investment strategies for your individual circumstances.

📚 Stay informed, stay vigilant, and make informed investment decisions. Happy investing!

This post topic: Gold Cryptocurrencies