Unveiling The Pros And Cons Of Digital Gold: Your Ultimate Guide

Digital Gold Pros and Cons

Introduction

Dear Readers,

Welcome to our article discussing the pros and cons of digital gold. In today’s fast-paced world, the digitalization of various aspects of our lives has become inevitable, including our financial transactions. Digital gold refers to the digitization of gold investments, allowing individuals to buy, sell, and trade gold online without physically owning the precious metal.

2 Picture Gallery: Unveiling The Pros And Cons Of Digital Gold: Your Ultimate Guide

In this article, we will explore the various aspects of digital gold, its advantages, disadvantages, and the factors to consider before investing. By the end, you will be equipped with valuable insights to make informed decisions regarding digital gold investments.

Now, let’s dive into the details!

What is Digital Gold?

✨ Digital gold refers to the electronic representation of gold, allowing investors to buy, sell, and trade gold without physically owning the metal. It is a form of investment that leverages technology to provide individuals with exposure to gold’s price movements.

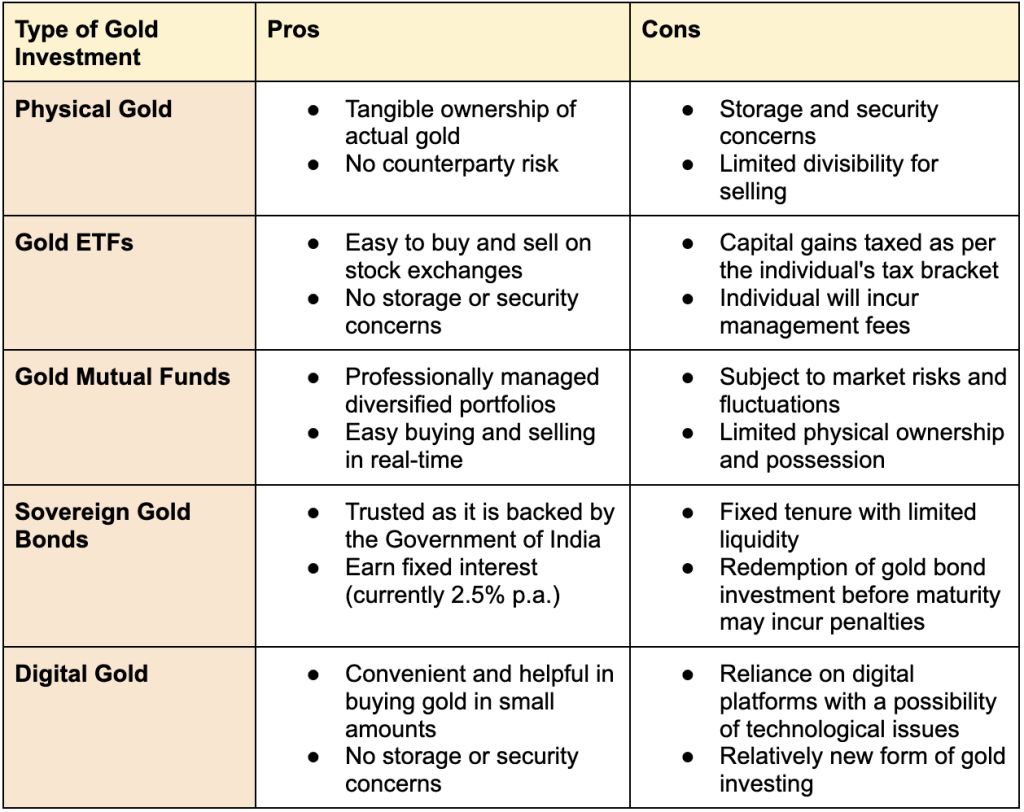

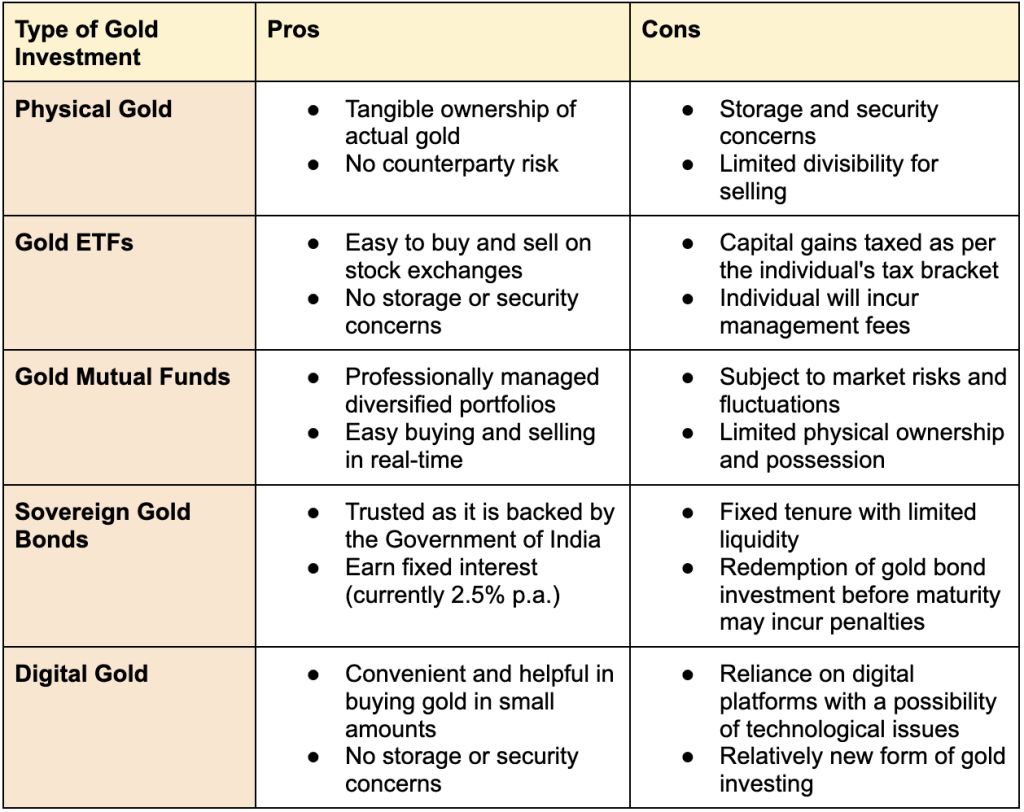

Image Source: webflow.com

✨ Who can Invest in Digital Gold?

✨ When can You Invest in Digital Gold?

✨ Where can You Invest in Digital Gold?

✨ Why Should You Consider Digital Gold Investments?

✨ How Does Digital Gold Work?

Advantages of Digital Gold

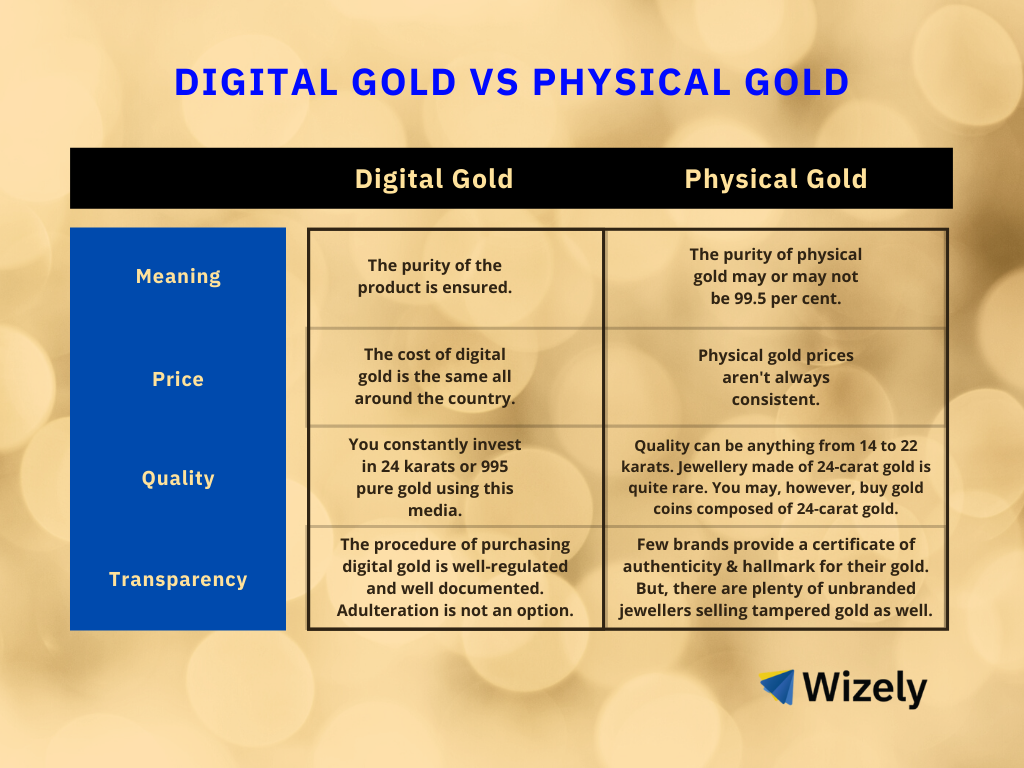

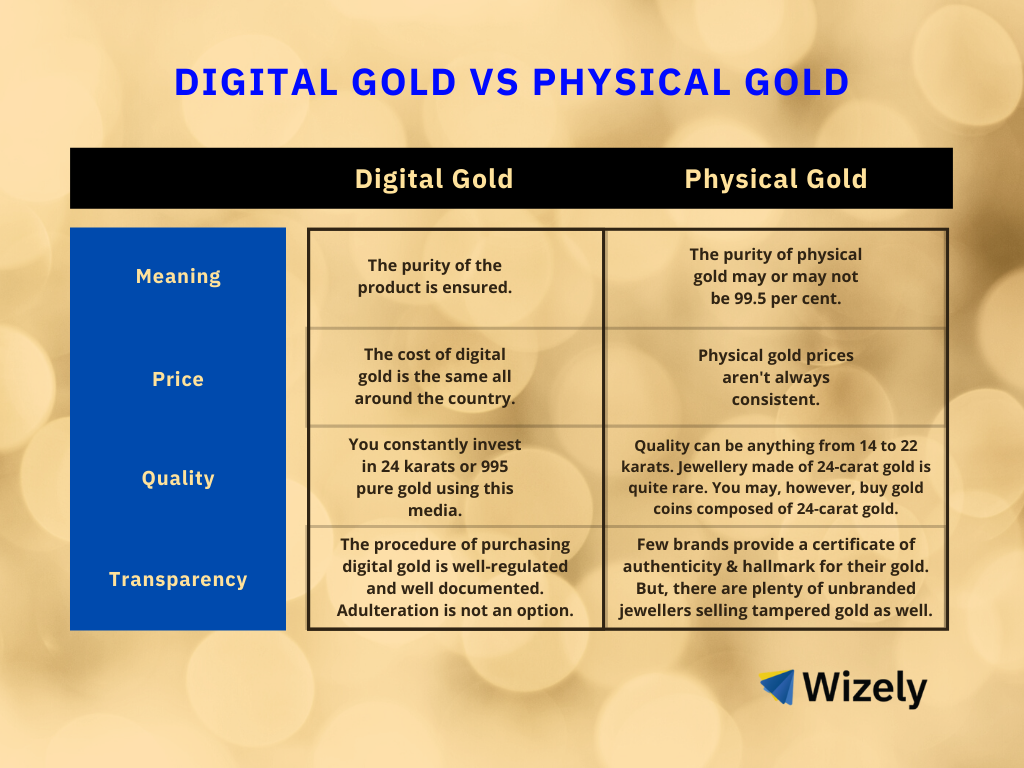

Image Source: wizely.in

✨ Convenience: Investing in digital gold eliminates the need for physical gold storage and transportation, providing ease of access and reducing associated risks.

✨ Global Accessibility: Digital gold can be purchased and traded from anywhere in the world, providing investors with a global platform to participate in the gold market.

✨ Fractional Ownership: Digital gold allows investors to own fractions of gold, making it more affordable and accessible to a broader range of individuals.

✨ Transparency: Transactions involving digital gold are often recorded on a blockchain, ensuring transparency and reducing the risk of fraud.

✨ Flexibility: Digital gold investments offer flexibility in terms of buying, selling, and trading, enabling investors to adapt to market conditions quickly.

Disadvantages of Digital Gold

✨ Market Volatility: The price of digital gold can be subject to significant fluctuations, just like physical gold, making it a potentially volatile investment.

✨ Cybersecurity Risks: As with any online investment, digital gold carries the risk of cyber threats, such as hacking or fraudulent activities.

✨ Dependence on Technology: Digital gold investments are reliant on technology, and any technical glitches or system failures can disrupt transactions and access to investments.

✨ Limited Regulation: The digital gold market is still evolving, and regulatory frameworks may not be as robust compared to traditional financial markets, potentially exposing investors to higher risks.

✨ Lack of Tangibility: Unlike physical gold, digital gold does not provide the satisfaction of owning a tangible asset, which may deter some investors seeking a more traditional investment experience.

Frequently Asked Questions (FAQs)

1. Is digital gold a safe investment?

Yes, digital gold can be a safe investment option when proper security measures are in place. It is crucial to choose reputable platforms and take precautionary measures to protect your digital assets.

2. Can I convert digital gold into physical gold?

In some cases, it is possible to convert digital gold into physical gold, depending on the platform you are using. However, it is essential to check the terms and conditions of the platform before making any assumptions.

3. Are there any tax implications with digital gold investments?

Tax implications associated with digital gold investments vary depending on your jurisdiction. It is advisable to consult with a tax professional to understand the tax obligations specific to your situation.

4. Are there any storage fees for digital gold?

Storage fees for digital gold vary depending on the platform or service provider. Some platforms may charge a nominal fee for storage, while others may include it in the transaction fees. It is essential to review the terms and conditions before investing.

5. Can I access my digital gold investments at any time?

Yes, digital gold investments generally provide investors with 24/7 access to their holdings. However, it is advisable to check the platform’s terms and conditions to ensure uninterrupted access.

Conclusion

In conclusion, digital gold offers numerous advantages such as convenience, global accessibility, and fractional ownership. However, it also poses certain risks, including market volatility and cybersecurity threats. Before investing in digital gold, it is crucial to thoroughly research and understand the associated pros and cons. Consider your risk tolerance, investment goals, and consult with financial professionals if needed.

We hope this article has provided you with valuable insights into the world of digital gold. Take the time to evaluate your options and make informed investment decisions. Happy investing!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial or investment advice. Investing in digital gold carries risks, and individuals should conduct their own research and seek professional guidance before making any investment decisions. Remember to only invest what you can afford to lose.

This post topic: Gold Cryptocurrencies