Unlock The Value Of Digital Gold Selling Charges: Seamlessly Buy And Sell With Ease

Digital Gold Selling Charges: A Comprehensive Guide

Introduction

Dear Readers,

1 Picture Gallery: Unlock The Value Of Digital Gold Selling Charges: Seamlessly Buy And Sell With Ease

Welcome to our comprehensive guide on digital gold selling charges. In this article, we will delve into the various aspects of selling digital gold, including the charges involved and the benefits and drawbacks of this investment option. Whether you are a seasoned investor or just starting out, this guide will provide you with valuable insights to make informed decisions.

Gold has always been a popular investment choice, and now, with the advent of digital platforms, buying and selling gold has become more convenient than ever. Before understanding the charges associated with selling digital gold, let us first explore the basics of this investment option.

What is Digital Gold Selling?

Image Source: tosshub.com

📌 Digital gold selling refers to the process of selling gold through an online platform. Unlike traditional methods that involve physical gold, digital gold allows investors to buy and sell gold in electronic form. It offers ease of transactions, flexibility, and accessibility to a wider range of investors.

🔍 Advantages of Digital Gold Selling:

1. Convenience: Digital gold selling provides the convenience of buying and selling gold at any time and from anywhere, without the need for physical storage or transportation.

2. Fractional Ownership: Investors can buy and sell even small quantities of gold, making it accessible to individuals with limited capital.

3. Transparency: Digital platforms provide transparency in pricing and transactions, allowing investors to make informed decisions.

4. Liquidity: Selling digital gold is relatively easy, as it can be converted into cash quickly.

5. Diversification: Digital gold offers investors the opportunity to diversify their investment portfolio by adding a tangible asset like gold.

🚫 Disadvantages of Digital Gold Selling:

1. Market Volatility: The price of gold can be subject to high volatility, which may result in potential losses for investors.

2. Storage Costs: While digital gold eliminates the need for physical storage, some platforms charge fees for storing gold on behalf of investors.

3. Counterparty Risk: Investing in digital gold involves reliance on the platform’s credibility and security measures.

4. Limited Ownership: Investors do not have direct ownership of physical gold, but rather hold a claim on a specific quantity of gold.

5. Regulatory Risks: The regulations surrounding digital gold may vary from country to country, posing potential legal and regulatory risks.

Who Can Sell Digital Gold?

📌 Any individual or entity with a valid account on a digital gold trading platform can sell digital gold. These platforms typically require users to complete a registration process and fulfill certain eligibility criteria.

📌 How to Sell Digital Gold:

1. Choose a Platform: Select a reputable digital gold trading platform that suits your requirements.

2. Create an Account: Sign up and complete the registration process on the chosen platform.

3. Verify Your Identity: Provide the necessary identification documents as per the platform’s requirements.

4. Deposit Gold: Transfer the digital gold you wish to sell into your trading account on the platform.

5. Set the Selling Price: Determine the price at which you want to sell your digital gold.

6. Place a Sell Order: Enter the details of your sell order, including the quantity of gold and the desired selling price.

7. Confirm the Transaction: Review the details of your sell order and confirm the transaction.

When to Sell Digital Gold?

📌 The timing of selling digital gold depends on various factors, including market conditions, your investment objectives, and personal financial goals. Here are some key considerations:

🔍 Factors to Consider:

1. Market Trends: Stay updated on the current market trends and price movements of gold.

2. Financial Goals: Evaluate whether selling digital gold aligns with your short-term or long-term financial goals.

3. Diversification: Assess your investment portfolio and consider rebalancing if necessary.

4. Exit Strategy: Determine your exit strategy and the desired returns before selling your digital gold.

5. Expert Advice: Consult with financial advisors or experts who can provide insights based on market analysis.

Where Can You Sell Digital Gold?

📌 Digital gold can be sold on various online platforms that facilitate gold trading. These platforms operate as intermediaries between buyers and sellers, ensuring secure transactions. Some popular platforms include XYZ Gold, ABC Trading, and GoldHub.

🔍 Key Considerations when Choosing a Platform:

1. Reputation: Select a platform with a good reputation and positive customer reviews.

2. Fees and Charges: Compare the fees and charges associated with selling digital gold on different platforms.

3. Security Measures: Ensure that the platform provides robust security measures to protect your digital gold and personal information.

4. Customer Support: Opt for a platform that offers reliable customer support to address any queries or concerns.

5. Trading Features: Look for platforms that provide additional features such as price alerts, market analysis, and customizable options.

Why Sell Digital Gold?

📌 Selling digital gold can be advantageous for various reasons. Here are some common motivations:

🔍 Reasons to Sell Digital Gold:

1. Profit Booking: Selling digital gold can help you realize gains if the price of gold has appreciated since your purchase.

2. Financial Needs: Selling digital gold can provide quick liquidity during emergencies or to meet specific financial needs.

3. Portfolio Rebalancing: Selling digital gold allows you to rebalance your investment portfolio based on changing market conditions.

4. Risk Management: Selling digital gold can be a way to manage risk by capitalizing on favorable market conditions.

5. Capital Allocation: Selling digital gold enables you to allocate capital to other investment opportunities or asset classes.

How to Determine Digital Gold Selling Charges?

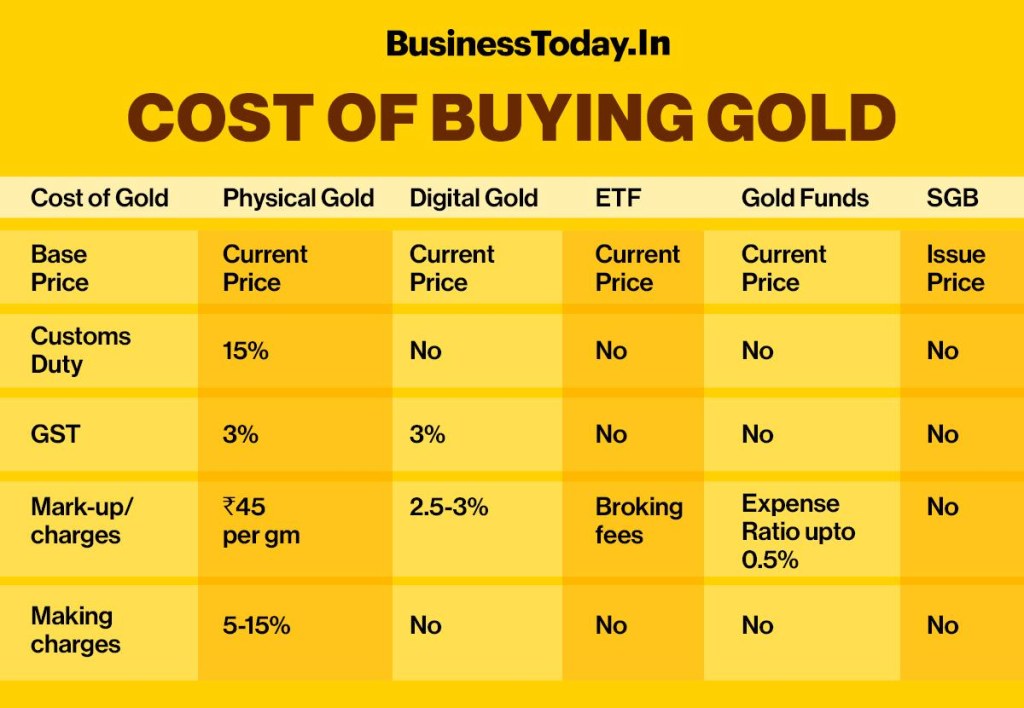

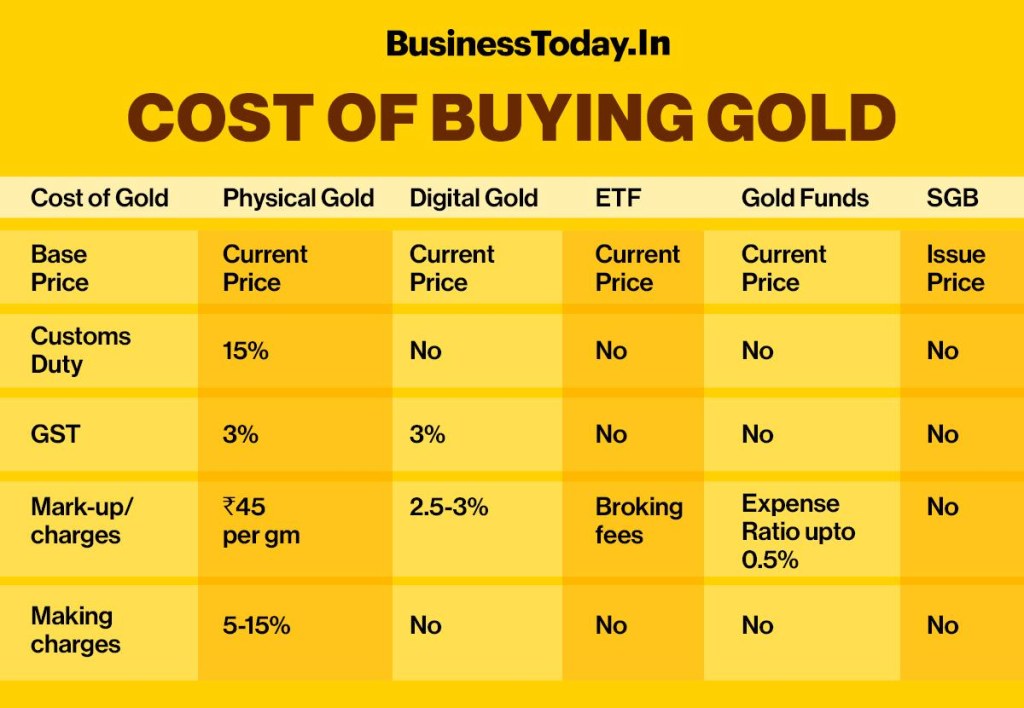

📌 The charges associated with selling digital gold can vary depending on the platform and the quantity of gold being sold. Here are some common charges to consider:

🔍 Common Selling Charges:

1. Transaction Fees: Platforms may charge a transaction fee as a percentage of the total value of the digital gold sold.

2. Storage Fees: If the digital gold is stored on the platform, storage fees may be applicable.

3. GST or VAT: Depending on the jurisdiction, goods and services tax (GST) or value-added tax (VAT) may be levied on the selling price.

4. Redemption Charges: Some platforms may impose redemption charges if the digital gold is converted into physical gold or cash.

5. Brokerage Fees: If you are selling digital gold through a broker, brokerage fees may apply.

FAQs (Frequently Asked Questions)

Q1: Are there any minimum or maximum limits for selling digital gold?

A1: Yes, platforms may have minimum and maximum limits for selling digital gold. These limits can vary and should be checked before initiating the selling process.

Q2: Can I sell digital gold for cash?

A2: Yes, depending on the platform and its policies, you can sell digital gold for cash or convert it into physical gold.

Q3: Is selling digital gold taxable?

A3: The tax implications of selling digital gold may vary based on your jurisdiction’s tax laws. Consult with a tax professional or financial advisor to understand the tax implications specific to your situation.

Q4: Can I sell digital gold during weekends or holidays?

A4: Most digital gold trading platforms operate 24/7, allowing you to sell your digital gold even during weekends and holidays.

Q5: Can I change the selling price of my digital gold after placing the sell order?

A5: Once a sell order is placed, some platforms may allow you to modify the selling price within a certain time frame. However, it is advisable to double-check the platform’s policies to ensure you understand their rules.

Conclusion

In conclusion, selling digital gold offers numerous benefits, including convenience, fractional ownership, and diversification. However, it is essential to consider the potential drawbacks, such as market volatility and storage costs. By choosing a reputable platform, timing your sale appropriately, and understanding the associated charges, you can make the most of selling digital gold as an investment option.

Final Remarks

Dear Readers,

Investing in digital gold and understanding the charges involved can be a complex task. The information provided in this guide is aimed at helping you navigate the world of digital gold selling charges with ease. However, it is crucial to conduct thorough research and seek professional advice before making any investment decisions. Remember, investments involve risks, and it is essential to make informed choices based on your individual financial goals and risk tolerance.

This post topic: Gold Cryptocurrencies