The Ultimate Investment Strategy For 30-Year-Olds: Secure Your Financial Future Now!

Investment Strategy for 30 Year Olds

Introduction

Dear Readers,

2 Picture Gallery: The Ultimate Investment Strategy For 30-Year-Olds: Secure Your Financial Future Now!

Welcome to our guide on investment strategies for 30 year olds. In today’s fast-paced world, it is crucial to start planning for your financial future as early as possible. As a 30 year old, you have a unique advantage of time on your side. This article aims to provide you with valuable insights and guidance on how to make the most of your investments and secure a prosperous future.

Image Source: insider.com

Now, let’s dive into the world of investment strategies for 30 year olds!

The What of Investment Strategy for 30 Year Olds

🔍 What exactly is an investment strategy for 30 year olds? It refers to a tailored approach to investing that takes into account your current financial situation, long-term goals, risk tolerance, and time horizon. It involves making informed decisions about asset allocation, diversification, and investment vehicles to maximize returns and minimize risks.

Here are the key components of a successful investment strategy:

Image Source: barbarafriedbergpersonalfinance.com

Setting clear financial goals

Understanding your risk tolerance

Creating a diversified portfolio

Regularly reviewing and rebalancing your investments

Considering tax-efficient investment strategies

Staying informed about market trends and economic indicators

Seeking professional advice when needed

The Who of Investment Strategy for 30 Year Olds

🕵️♂️ Who should consider following an investment strategy at the age of 30? The answer is simple – anyone who wants to secure their financial future and build wealth over time. Whether you are just starting your career or have already been working for a few years, it is never too early or too late to adopt a strategic approach to investing.

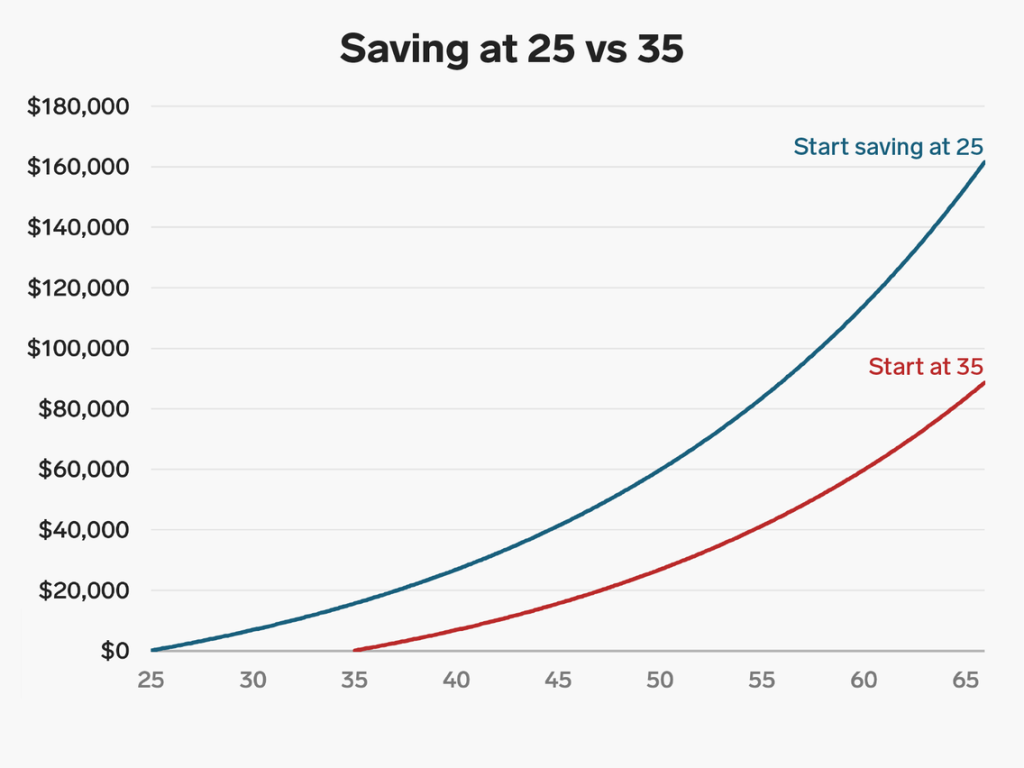

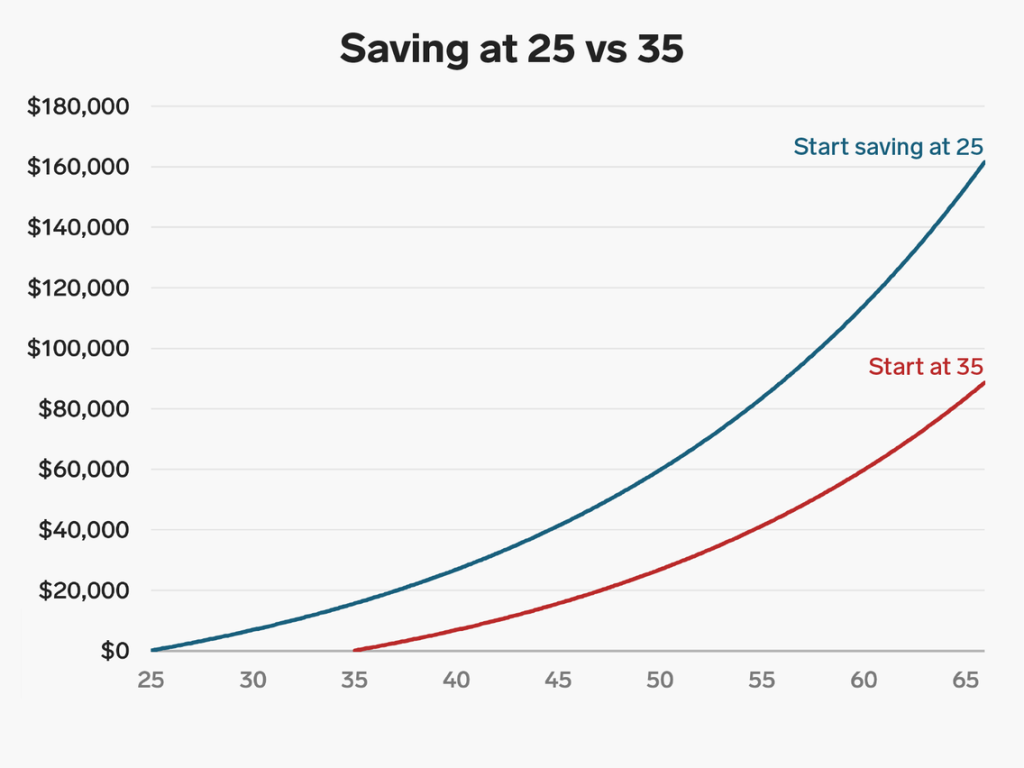

By starting early, you can take advantage of the power of compounding and potentially accumulate substantial wealth by the time you retire. So, if you’re a 30 year old looking to make smart financial decisions, an investment strategy is essential for you.

The When of Investment Strategy for 30 Year Olds

📅 When should you start implementing an investment strategy? The answer is now! Time is a valuable asset in the world of investing, and the earlier you start, the more time your investments have to grow and compound.

By starting in your 30s, you have a significant advantage over those who delay investing until later in life. This extra time allows you to potentially take on more risk and benefit from the growth potential of riskier assets such as stocks. However, it is important to remember that everyone’s financial situation is unique, and it is never too late to start investing.

The Where of Investment Strategy for 30 Year Olds

🌍 Where should you invest your money as a 30 year old? The answer depends on your financial goals, risk tolerance, and investment knowledge. Typically, a diversified portfolio is recommended, which may include a mix of stocks, bonds, real estate, and other asset classes.

Stocks offer the potential for higher returns but come with greater volatility. Bonds, on the other hand, tend to be more stable but offer lower returns. Real estate can provide both income and capital appreciation. It’s essential to understand the characteristics and risks of each asset class before making investment decisions.

The Why of Investment Strategy for 30 Year Olds

❓ Why should you adopt an investment strategy as a 30 year old? The primary reason is to secure your financial future and build wealth over time. By investing strategically, you can potentially earn higher returns compared to keeping your money in low-interest savings accounts.

Additionally, an investment strategy allows you to take advantage of compound interest and the power of long-term investing. By starting early and consistently investing, you can benefit from the compounding effect, which can significantly boost your wealth in the long run.

The How of Investment Strategy for 30 Year Olds

🔧 How can you create an effective investment strategy as a 30 year old? Here are some steps to follow:

Set clear financial goals: Define your short-term and long-term financial objectives.

Assess your risk tolerance: Determine how much risk you are willing to take with your investments.

Create a diversified portfolio: Allocate your investments across different asset classes to spread risks.

Regularly review and rebalance: Monitor your portfolio and make adjustments as needed to maintain the desired asset allocation.

Consider tax-efficient strategies: Optimize your investments to minimize tax liabilities.

Stay informed: Keep up-to-date with market trends and economic indicators that may impact your investments.

Seek professional advice: Consult with a financial advisor to get personalized guidance based on your specific circumstances.

Advantages and Disadvantages of Investment Strategy for 30 Year Olds

👍 Advantages:

Potential for higher long-term returns

Ability to benefit from compounding

Opportunity to build wealth for retirement

Flexibility to adjust investment strategy over time

Access to a wide range of investment options

👎 Disadvantages:

Risk of short-term market volatility

Potential for investment losses

Requires ongoing monitoring and adjustments

May involve fees and expenses

Requires financial discipline and patience

Frequently Asked Questions (FAQ)

1. Can I start investing in my 30s?

Absolutely! While it’s ideal to start investing as early as possible, it’s never too late to begin. The key is to create a well-thought-out investment strategy and stick to it.

2. How much should I invest at 30?

There is no one-size-fits-all answer to this question. The amount you should invest depends on your income, expenses, and financial goals. It’s crucial to create a budget and allocate a portion of your income towards investments.

3. Should I prioritize paying off debt or investing?

It depends on the interest rates of your debts and the potential returns on your investments. Generally, it’s recommended to prioritize paying off high-interest debts before investing. However, low-interest debts may not hinder your ability to start investing.

4. What is the role of an emergency fund in my investment strategy?

An emergency fund is a crucial component of any financial plan. It provides a safety net in case of unexpected expenses or loss of income. Before investing, it’s recommended to build an emergency fund that covers at least 3-6 months of living expenses.

5. Should I seek professional advice for my investment strategy?

While it’s not mandatory, seeking professional advice can provide valuable insights and guidance tailored to your specific financial situation. A financial advisor can help you create a personalized investment strategy and navigate the complex world of investing.

Conclusion

Dear Readers,

By now, you should have a solid understanding of investment strategies for 30 year olds. Remember, the key to successful investing is to start early, create a diversified portfolio, regularly monitor and adjust your investments, and stay informed about market trends.

While investing involves risks, it also presents tremendous opportunities to grow your wealth and secure a prosperous future. Take the knowledge gained from this article and put it into action. Start building your investment strategy today and take control of your financial future!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Investing involves risks, and it’s essential to conduct thorough research and seek professional advice before making any investment decisions. The authors and website shall not be held responsible for any financial losses or damages resulting from the use of this information. Invest wisely and at your own risk.

This post topic: Gold Cryptocurrencies