Maximizing Your Investment Strategy At 35: Unlocking Financial Success With Smart Choices

Investment Strategy at 35

Introduction

Dear Readers,

2 Picture Gallery: Maximizing Your Investment Strategy At 35: Unlocking Financial Success With Smart Choices

Welcome to our article on investment strategy at 35. In today’s fast-paced world, it is essential to have a solid financial plan, especially as you approach your mid-thirties. This is a crucial time in your life when you should start thinking about your long-term financial goals and how to achieve them.

In this article, we will discuss various aspects of investment strategy at 35, including what it entails, who can benefit from it, when is the right time to start, where to invest, why it is important, and how to go about implementing it. By the end of this article, we hope to provide you with valuable insights and guidance to help you make informed decisions regarding your investments.

What is Investment Strategy at 35?

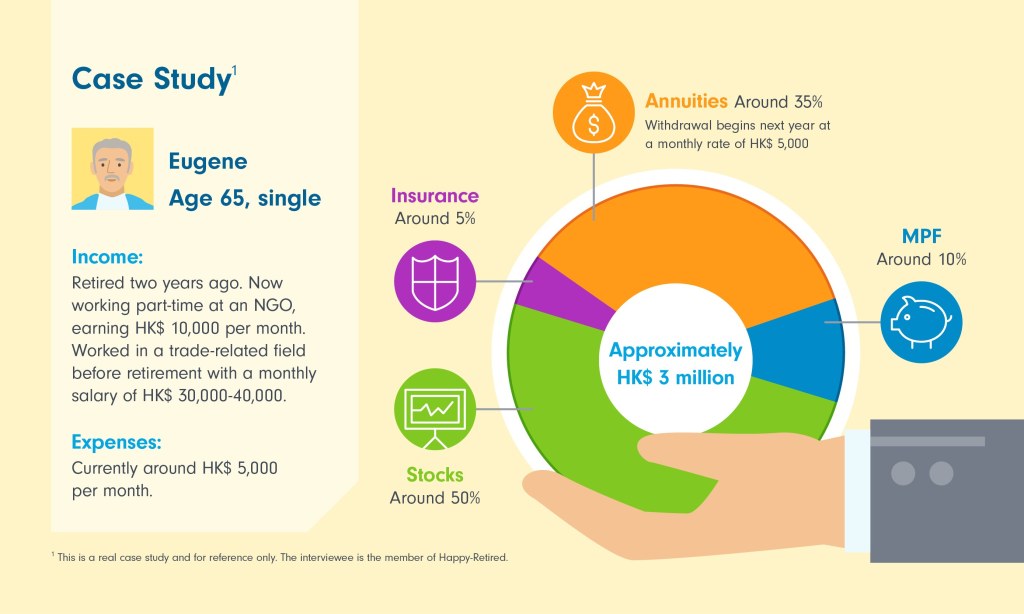

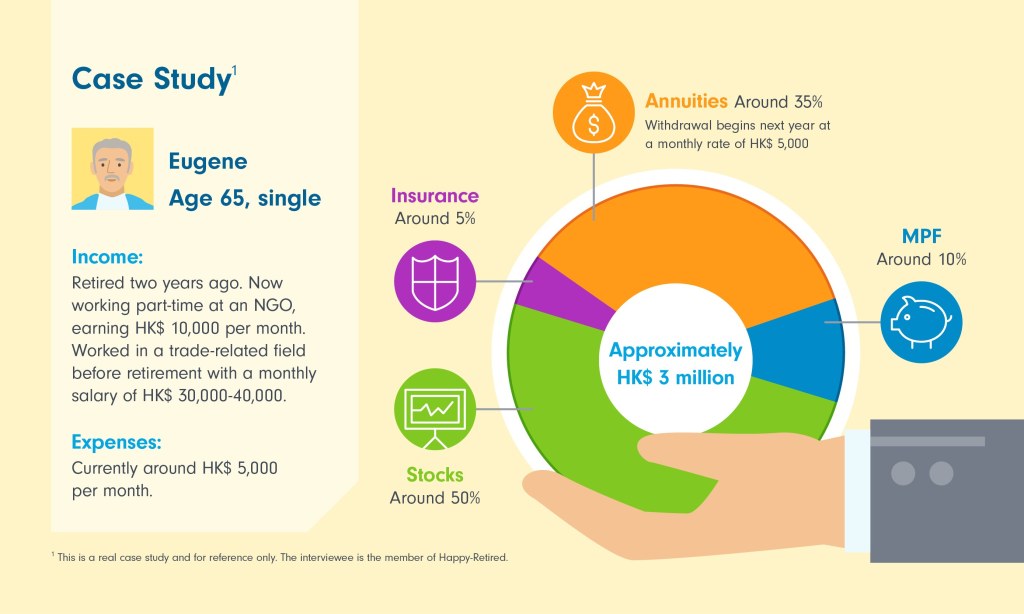

Image Source: fidelity.com.hk

🔍 At its core, investment strategy at 35 refers to the financial plan and choices individuals make in their mid-thirties to secure their future. It involves allocating funds to different investment avenues with the aim of generating income, growing wealth, and achieving long-term financial goals.

Who Can Benefit from Investment Strategy at 35?

🔍 Investment strategy at 35 is relevant for individuals who have reached their mid-thirties and are looking to build a strong financial foundation. Whether you are starting from scratch or have already begun investing, having a well-defined investment strategy can benefit anyone who wants to secure their financial future.

When Should You Start?

🔍 The earlier you start planning and implementing your investment strategy, the better. However, if you haven’t started yet, don’t worry. It’s never too late to begin. By starting in your mid-thirties, you still have several decades ahead of you to invest and grow your wealth.

Where to Invest?

Image Source: slidemembers.com

🔍 There are various investment options available for individuals at 35. Some popular choices include stocks, bonds, real estate, mutual funds, and retirement accounts. The key is to diversify your portfolio and choose investments that align with your risk tolerance and financial goals.

Why is Investment Strategy at 35 Important?

🔍 Investing at 35 is crucial because it allows you to take advantage of the power of compounding. The earlier you start investing, the more time your money has to grow. Additionally, investing in a well-thought-out strategy can help you achieve financial independence, retire comfortably, and meet other important life goals.

How to Implement Investment Strategy at 35?

🔍 Implementing your investment strategy at 35 requires careful planning and decision-making. It’s important to assess your financial situation, determine your risk tolerance, set clear investment goals, and create a diversified portfolio. Regular monitoring and adjustments are also necessary to ensure your investments remain aligned with your goals.

Advantages and Disadvantages of Investment Strategy at 35

Advantages:

👍 Potential for long-term wealth accumulation

👍 Opportunity to take advantage of compounding

👍 Increased likelihood of achieving financial independence

👍 Diversification helps manage risk

👍 Flexibility to adjust investments based on changing goals

Disadvantages:

👎 Investments carry inherent risks

👎 Market volatility can lead to fluctuations in portfolio value

👎 Requires time and effort for research and monitoring

👎 Financial goals may not be met due to unforeseen circumstances

👎 Potential for loss of capital if investments perform poorly

Frequently Asked Questions

1. Is 35 too late to start investing?

🔍 No, 35 is not too late to start investing. While it’s better to start early, you still have plenty of time to build a solid financial foundation and grow your wealth.

2. How much should I invest at 35?

🔍 The amount you should invest at 35 depends on your financial situation and goals. It’s recommended to save and invest at least 10-20% of your income.

3. Should I prioritize paying off debt or investing at 35?

🔍 It depends on the interest rates of your debts and your financial goals. Generally, it’s advisable to pay off high-interest debts first and then focus on investing.

4. What is the best investment strategy at 35?

🔍 The best investment strategy at 35 varies from person to person. It’s essential to consider your risk tolerance, financial goals, and time horizon when devising your strategy.

5. Should I seek professional advice for my investment strategy at 35?

🔍 It can be beneficial to consult a financial advisor who can provide personalized guidance based on your unique financial situation and goals.

Conclusion

In conclusion, implementing an investment strategy at 35 is crucial for securing your financial future. By starting early, diversifying your investments, and regularly reviewing your portfolio, you can maximize your chances of achieving long-term financial goals and enjoying a comfortable retirement. Remember, it’s never too late to start, but the earlier you begin, the greater the potential for growth.

Final Remarks

🔍 The information provided in this article is for educational purposes only and should not be considered as financial advice. Investing involves risks, and it’s essential to conduct thorough research and seek professional guidance before making any investment decisions. The authors and publishers of this article are not liable for any financial losses or damages incurred.

This post topic: Gold Cryptocurrencies