Unveiling The Pros And Cons Of Digital Gold: Uncover Its Advantages And Disadvantages Today!

Digital Gold Advantages and Disadvantages

Introduction

Dear Readers,

1 Picture Gallery: Unveiling The Pros And Cons Of Digital Gold: Uncover Its Advantages And Disadvantages Today!

Welcome to an in-depth exploration of the advantages and disadvantages of digital gold. In this article, we will take a closer look at the benefits and drawbacks of this innovative concept in the realm of digital assets. As the cryptocurrency market continues to evolve, it is essential to understand the potential advantages and disadvantages that come with investing in digital gold.

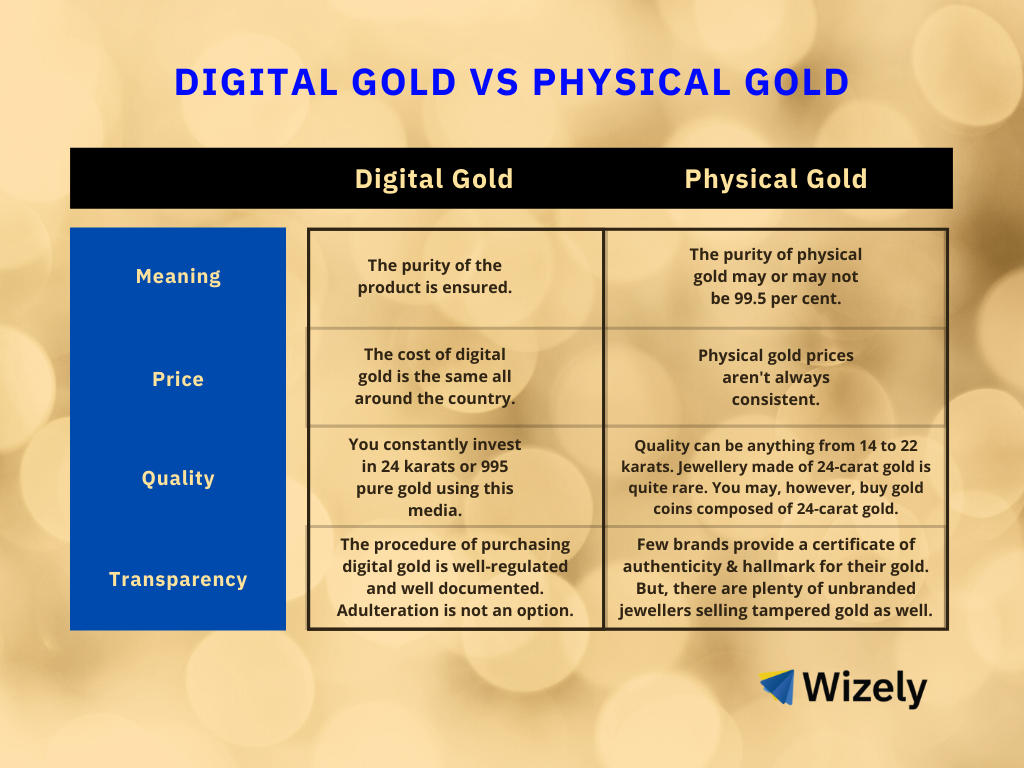

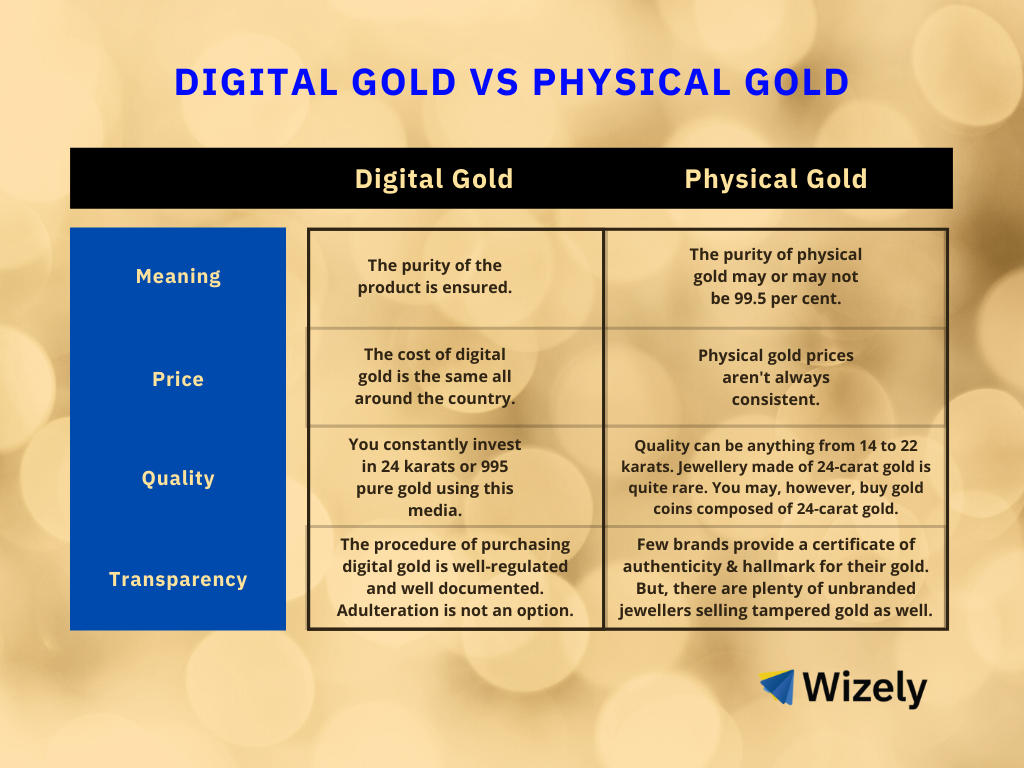

Image Source: wizely.in

Before we delve into the details, let us first understand what digital gold is and who it caters to.

What is Digital Gold?

Digital gold refers to a digital representation of gold, backed by physical gold reserves. It allows users to invest in gold without the need for physical ownership. Digital gold is typically exchanged on blockchain platforms and can be bought or sold in fractions, enabling investors to have greater flexibility in their gold investments.

Now that we know what digital gold is, let’s explore who can benefit from this innovative investment option.

Who Benefits from Digital Gold?

Digital gold offers several advantages to different types of individuals:

1. Investors: Investors can diversify their portfolio and hedge against inflation by including digital gold in their investment strategy.

2. Traders: Traders can take advantage of the price volatility of digital gold to make short-term gains in the cryptocurrency market.

3. Gold Enthusiasts: Individuals who have a strong affinity for gold but prefer the convenience and security of digital assets can easily invest in digital gold.

4. Global Market Participants: Digital gold allows people from all over the world to access the gold market without geographical restrictions.

Now that we know who can benefit from digital gold, let’s explore when and where it originated.

When and Where Did Digital Gold Originate?

The concept of digital gold originated with the introduction of Bitcoin in 2009. Bitcoin paved the way for the development of various cryptocurrencies, including those backed by gold. The emergence of blockchain technology enabled the creation of secure and transparent platforms for trading digital gold.

Now that we understand the origins of digital gold, let’s dive into the reasons why it has gained popularity.

Why is Digital Gold Popular?

Digital gold offers several advantages that have contributed to its popularity:

1. Accessibility: Digital gold allows anyone with an internet connection to invest in gold, regardless of their location or financial status.

2. Security: Blockchain technology ensures the security and immutability of transactions, providing investors with peace of mind.

3. Flexibility: Digital gold can be bought or sold in fractions, allowing investors to tailor their investments according to their needs.

4. Liquidity: The ability to trade digital gold 24/7 ensures high liquidity, enabling investors to enter or exit their positions at any time.

5. Transparency: The use of blockchain technology provides transparency in ownership and transaction records, eliminating the need for intermediaries.

Now that we have explored the advantages of digital gold, let’s uncover its disadvantages.

Disadvantages of Digital Gold

Despite its popularity, digital gold has its share of disadvantages:

1. Volatility: Digital gold prices can be highly volatile, subjecting investors to significant fluctuations and potential losses.

2. Regulatory Concerns: The regulatory environment surrounding digital gold is still evolving, leading to uncertainty and potential risks.

3. Counterparty Risk: Investing in digital gold exposes investors to counterparty risk, as they rely on third-party platforms for storage and trading.

4. Technical Challenges: Individuals with limited technical knowledge may face challenges in navigating and securing their digital gold investments.

5. Limited Acceptance: Although digital gold is gaining acceptance, its adoption is still relatively low compared to traditional investment options.

Now that we have explored both the advantages and disadvantages of digital gold, let’s address some frequently asked questions.

Frequently Asked Questions

1. Is digital gold the same as physical gold?

No, digital gold represents a digital ownership of physical gold rather than physical ownership itself.

2. How can I buy digital gold?

You can buy digital gold through various platforms that offer this investment option.

3. Can I convert digital gold back into physical gold?

Yes, some platforms allow you to convert your digital gold into physical gold if desired.

4. What are the tax implications of investing in digital gold?

Tax regulations regarding digital gold may vary depending on your jurisdiction. It is advisable to consult a tax professional for accurate information.

5. Is digital gold a safe investment?

While digital gold offers security features, it is important to conduct thorough research and choose reputable platforms to mitigate risks.

Now that we have addressed some frequently asked questions, let’s conclude our discussion on digital gold.

Conclusion

In conclusion, digital gold presents investors with a convenient and accessible way to invest in gold. It offers several advantages, such as accessibility, security, flexibility, liquidity, and transparency. However, it also comes with certain disadvantages, including volatility, regulatory concerns, counterparty risk, technical challenges, and limited acceptance.

If you are considering investing in digital gold, it is important to weigh the pros and cons carefully and conduct thorough research. Choose reputable platforms and stay updated with the latest developments in this evolving market.

Remember, investing in any asset carries risks, and it is essential to make informed decisions. We hope this article has provided you with valuable insights into the advantages and disadvantages of digital gold.

Final Remarks

Dear Friends,

It is important to note that the information provided in this article is for educational purposes only and should not be considered financial advice. Investing in digital gold or any other asset carries risks, and it is advisable to consult a financial advisor before making any investment decisions.

Thank you for reading, and we wish you the best in your investment journey!

This post topic: Gold Cryptocurrencies