Unlock The Power Of Digital Gold Exchange In India: Experience Seamless Trading And Lucrative Opportunities

Digital Gold Exchange India: A Comprehensive Guide

Introduction

Hello friends and welcome to this informative article about Digital Gold Exchange India. In this guide, we will explore the concept of digital gold exchange and its significance in the Indian market. With the growing interest in gold investments and the increasing popularity of digital platforms, understanding digital gold exchange in India is crucial for both investors and enthusiasts alike. So let’s dive in and explore the world of digital gold exchange!

1 Picture Gallery: Unlock The Power Of Digital Gold Exchange In India: Experience Seamless Trading And Lucrative Opportunities

Table of Contents

1. What is Digital Gold Exchange?

2. Who Can Benefit from Digital Gold Exchange?

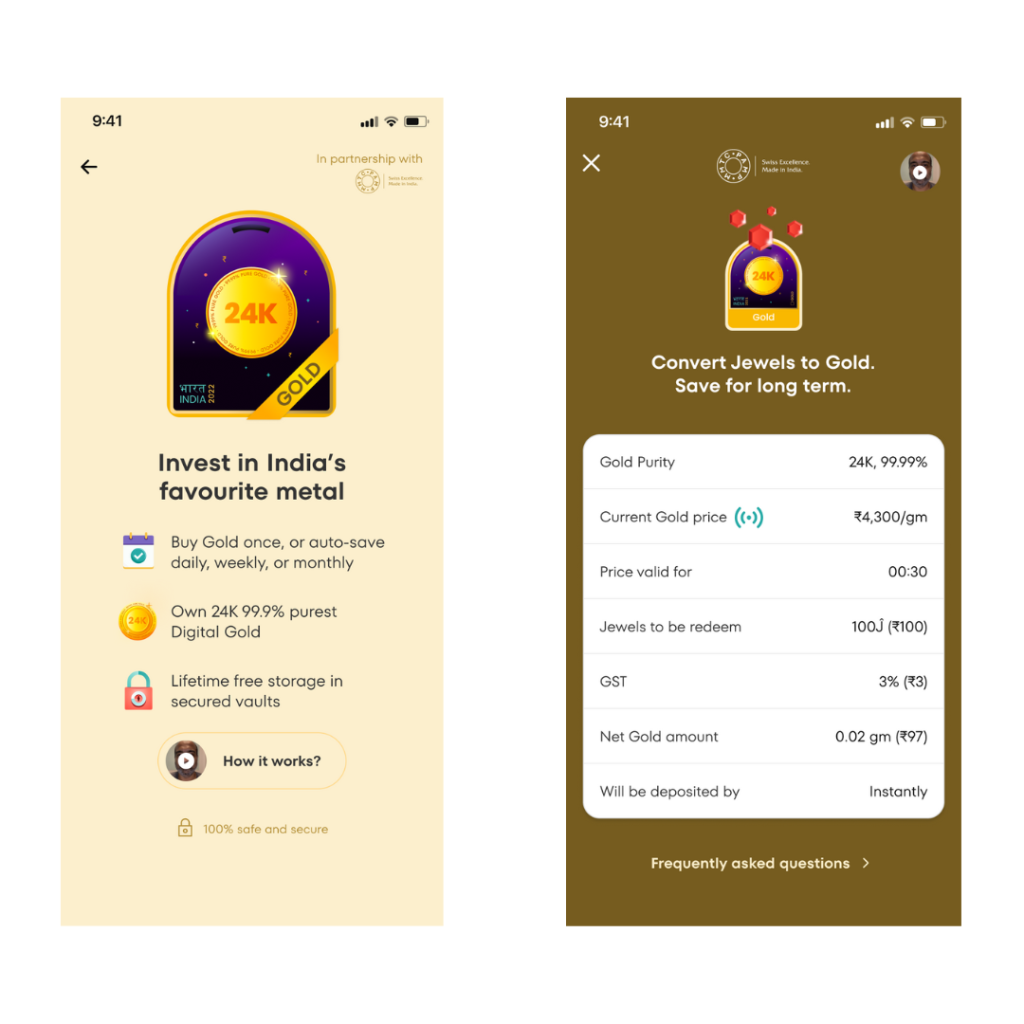

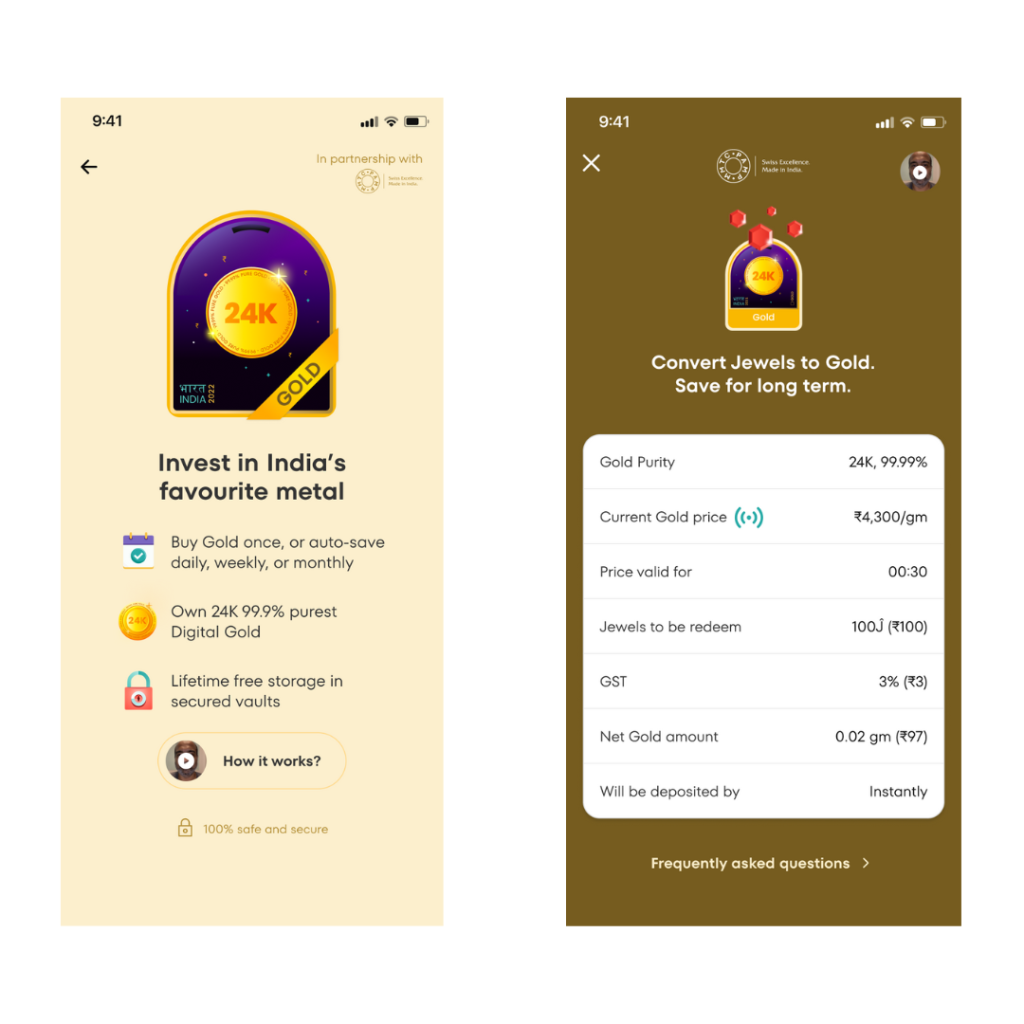

Image Source: jupiter.money

3. When Did Digital Gold Exchange Start in India?

4. Where Can You Access Digital Gold Exchange?

5. Why Should You Consider Digital Gold Exchange?

6. How Does Digital Gold Exchange Work?

7. Advantages and Disadvantages of Digital Gold Exchange

8. Frequently Asked Questions (FAQs)

9. Conclusion

10. Final Remarks

What is Digital Gold Exchange?

🔍 Digital Gold Exchange refers to the online platform where individuals can buy, sell, and trade gold in digital form. It allows investors to own fractional quantities of physical gold without the need for physical possession. Digital gold exchanges in India operate similarly to stock exchanges, providing a convenient and secure way to invest in gold.

Who Can Benefit from Digital Gold Exchange?

🔍 Digital gold exchange platforms in India cater to a wide range of individuals. Whether you are a seasoned investor looking to diversify your portfolio or a novice interested in starting gold investments, digital gold exchange offers accessibility and flexibility. Additionally, it provides an opportunity for individuals who may not have large sums of money to invest in traditional gold assets.

When Did Digital Gold Exchange Start in India?

🔍 The concept of digital gold exchange gained traction in India in recent years with the introduction of various online platforms. The availability of digital gold exchange started around 2016 and has since witnessed significant growth. This modern investment avenue has revolutionized the way Indians invest in gold and has become an attractive alternative to traditional methods.

Where Can You Access Digital Gold Exchange?

🔍 Digital gold exchange platforms can be accessed through websites and mobile applications. Several well-established companies in India offer digital gold exchange services, providing a user-friendly interface for seamless transactions. These platforms ensure transparency, security, and ease of use, making it convenient for investors to buy, sell, and hold digital gold.

Why Should You Consider Digital Gold Exchange?

🔍 There are several compelling reasons to consider digital gold exchange in India. Firstly, it offers a convenient way to invest in gold without the hassles of physical storage and security. Additionally, digital gold exchange provides flexibility, allowing investors to buy and sell gold at any time, depending on the market conditions. Moreover, it offers fractional ownership, making gold investments more accessible to a wider audience.

How Does Digital Gold Exchange Work?

🔍 Digital gold exchange platforms operate by allowing individuals to purchase gold in small denominations known as units or grams. These units are backed by physical gold stored in secure vaults. Investors can buy and sell these units at market prices, often with the option to convert them into physical gold or receive cash equivalent. The transactions are facilitated through the digital platform, ensuring transparency and security.

Advantages and Disadvantages of Digital Gold Exchange

🔍 Like any investment option, digital gold exchange in India comes with its pros and cons. Let’s explore them in detail:

Advantages:

1. Accessibility: Digital gold exchange platforms offer easy access to gold investments for individuals with limited funds.

2. Flexibility: Investors can buy and sell digital gold units based on their requirements, increasing the flexibility of investment decisions.

3. Security: Digital gold exchanges ensure secure storage of physical gold, eliminating the risk of theft or loss.

4. Transparency: These platforms provide transparent pricing and information about the gold holdings, allowing investors to make informed decisions.

5. Convenience: Investors can conveniently access their gold holdings and track market trends through user-friendly online platforms.

Disadvantages:

1. Price Fluctuations: The value of digital gold units can fluctuate based on market conditions, which may impact investment returns.

2. Market Risk: Like any investment, digital gold exchange carries the risk of market volatility and economic factors that can affect gold prices.

3. Counterparty Risk: Investors rely on the credibility and security measures implemented by digital gold exchange platforms.

4. Liquidity Constraints: Converting digital gold units into physical gold or cash may involve certain restrictions or charges.

5. Regulatory Factors: Changes in government policies or regulations can impact the functioning of digital gold exchange platforms.

Frequently Asked Questions (FAQs)

1. Is digital gold exchange safe?

Digital gold exchanges in India follow strict security measures, making it a relatively safe investment option. However, investors should choose reputed platforms and exercise caution while sharing personal and financial information.

2. Can I convert digital gold into physical gold?

Yes, many digital gold exchange platforms allow investors to convert their digital gold units into physical gold, subject to certain terms and conditions.

3. Are there any additional charges involved in digital gold exchange?

Digital gold exchange platforms may charge fees for transactions, storage, and conversions. It is advisable to carefully review the fee structure before investing.

4. What are the tax implications of digital gold exchange in India?

Taxation on digital gold exchange depends on various factors, including the holding period and the mode of conversion. Investors should consult with a tax advisor to understand the applicable tax regulations.

5. Can NRIs invest in digital gold exchange in India?

Yes, Non-Resident Indians (NRIs) are allowed to invest in digital gold exchange in India, subject to compliance with the Foreign Exchange Management Act (FEMA) guidelines.

Conclusion

In conclusion, digital gold exchange has emerged as a popular investment option in India, offering accessibility, flexibility, and convenience. It provides individuals with an opportunity to participate in the gold market without the need for physical possession. However, like any investment, it is important to understand the advantages, disadvantages, and associated risks before making investment decisions. By choosing reputable platforms and staying informed about market trends, investors can make the most of digital gold exchange.

Final Remarks

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute financial advice or a recommendation to invest in digital gold exchange. Investors are advised to conduct thorough research and consult with financial professionals before making any investment decisions. The article author and publisher shall not be held responsible for any losses or damages resulting from the use of the information contained herein.

This post topic: Gold Cryptocurrencies