Unlock The Potential: Exploring The Lucrative Digital Gold Interest Rate

Digital Gold Interest Rate: The Pros and Cons

Introduction

Greetings, readers! Today, we will delve into the world of digital gold interest rates, a topic that has been gaining traction in recent years. With the advancement of technology, individuals are now able to invest in gold without physically owning it. This article aims to provide a comprehensive overview of digital gold interest rates, including what they are, who they are suitable for, when and where to invest in them, why they are gaining popularity, and how to make the most of this investment opportunity. So, let’s dive in!

3 Picture Gallery: Unlock The Potential: Exploring The Lucrative Digital Gold Interest Rate

What is Digital Gold Interest Rate?

🔍 Digital gold interest rate refers to the interest earned on investments made in digital gold. Digital gold, also known as gold-backed cryptocurrency, allows individuals to invest in gold without the need to physically purchase, store, or transport it. These digital assets are backed by physical gold reserves and offer investors the opportunity to benefit from the potential price appreciation of gold.

How does it work?

Image Source: gadgets360cdn.com

🔍 Digital gold platforms enable users to buy and trade gold-backed tokens, which represent a certain amount of gold. The value of these tokens is linked to the current market price of gold, allowing investors to indirectly participate in the gold market. The digital gold interest rate is the return on investment received by individuals who hold these tokens over a specific period of time.

Who Should Consider Investing in Digital Gold?

🔍 Digital gold interest rates can be an attractive investment option for a wide range of individuals. Investors who are looking to diversify their portfolio, hedge against inflation, or protect their wealth during economic uncertainties may find digital gold to be a suitable choice. Additionally, those who are interested in investing in gold but are deterred by the logistical challenges associated with physical ownership may find digital gold to be a convenient alternative.

When and Where to Invest in Digital Gold?

🔍 The timing and platform for investing in digital gold can greatly impact the potential returns. It is crucial to carefully evaluate market conditions and choose a reputable digital gold provider. These providers typically offer various options for purchasing and storing digital gold, and it is important to select one that aligns with your investment goals and risk tolerance.

Why is Digital Gold Interest Rate Gaining Popularity?

Image Source: mygoldguide.in

🔍 The growing popularity of digital gold interest rates can be attributed to several factors. Firstly, the convenience and accessibility offered by digital gold platforms have democratized gold investments, allowing individuals with smaller budgets to participate. Additionally, the potential for price appreciation of gold, coupled with the ease of trading digital gold tokens, has attracted both seasoned investors and newcomers to this investment avenue.

Advantages and Disadvantages of Digital Gold Interest Rate

🔍 Like any investment, digital gold interest rates come with their own set of advantages and disadvantages. Let’s explore them:

Advantages

1. Diversification:

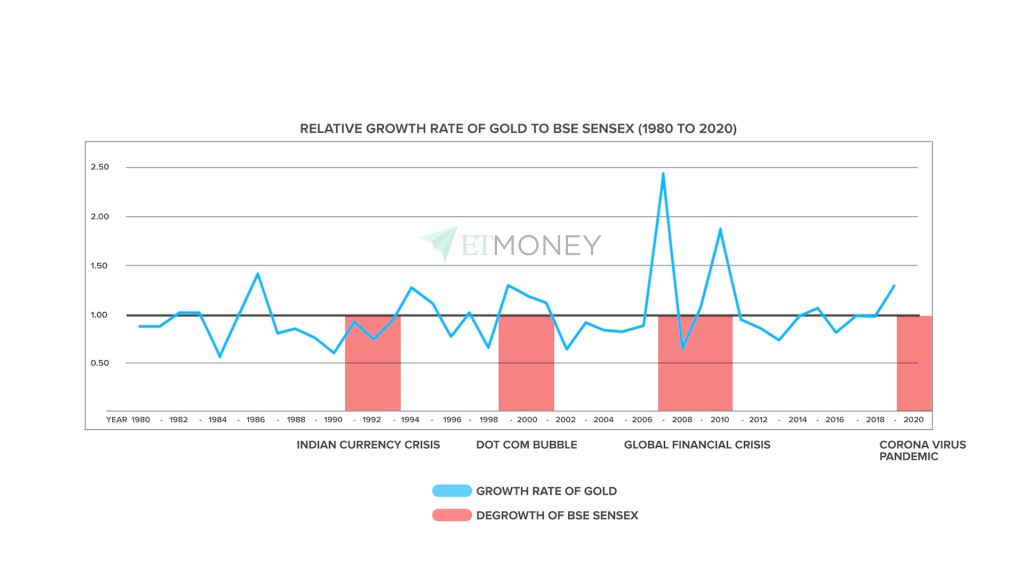

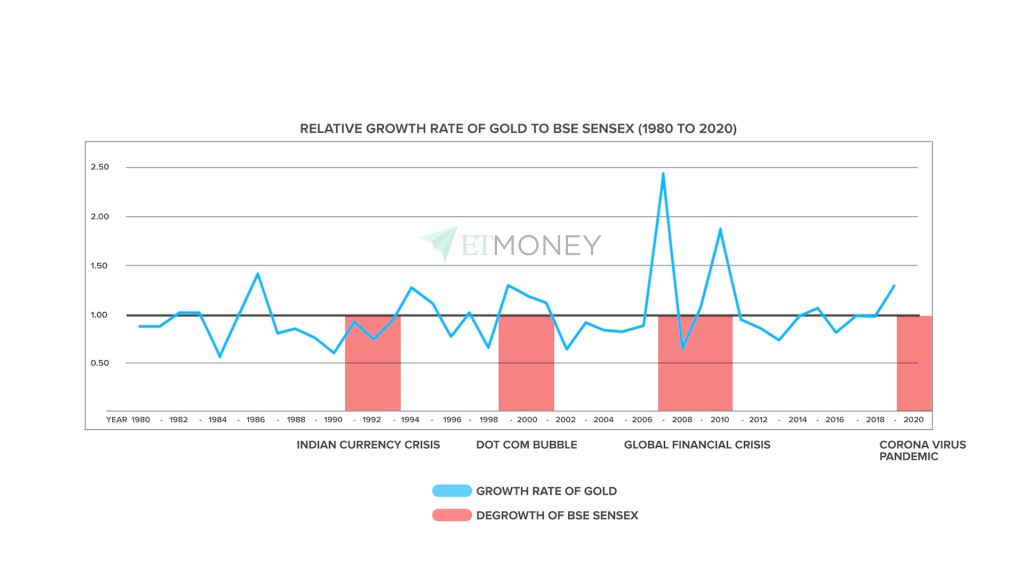

Image Source: etmoney.com

🔍 By investing in digital gold, individuals can diversify their portfolio and reduce overall investment risk. Gold has historically exhibited low correlation with other asset classes, making it an effective diversification tool.

2. Accessibility:

🔍 Unlike physical gold, investing in digital gold offers investors the convenience of buying and selling gold anytime and anywhere. Digital gold platforms operate 24/7, allowing for seamless transactions.

3. Fractional Ownership:

🔍 Digital gold allows individuals to own fractions of a gold bar or coin, making it accessible to investors with smaller budgets. This fractional ownership model enables investors to gradually accumulate gold over time.

4. Security:

🔍 Digital gold platforms typically employ advanced security measures to protect investors’ holdings. The use of blockchain technology ensures transparency and immutability of transactions, reducing the risk of fraud or theft.

5. Liquidity:

🔍 Investors can easily convert their digital gold holdings into fiat currency or other cryptocurrencies, providing liquidity when needed. This flexibility allows investors to take advantage of opportunities in other markets.

Disadvantages

1. Volatility:

🔍 The price of gold can be volatile, which may lead to fluctuations in the value of digital gold tokens. Investors should be prepared for potential price swings and consider their risk tolerance before investing.

2. Counterparty Risk:

🔍 When investing in digital gold, individuals rely on the trustworthiness and solvency of the provider. It is important to choose a reputable platform with a proven track record to minimize the risk of default or fraud.

3. Regulatory Environment:

🔍 The regulatory environment surrounding digital gold interest rates varies across jurisdictions. Investors should be aware of the legal and regulatory frameworks governing these investments in their respective countries.

4. Storage Costs:

🔍 While digital gold eliminates the need for physical storage, some platforms may charge storage fees or other transaction costs. Investors should consider these costs when evaluating the overall return on investment.

5. Lack of Tangibility:

🔍 Unlike physical gold, which investors can hold and touch, digital gold exists solely in the digital realm. Some individuals may prefer the tangible nature of physical gold as an investment.

FAQs (Frequently Asked Questions)

1. Is investing in digital gold interest rate the same as owning physical gold?

🔍 No, investing in digital gold interest rate involves buying and trading gold-backed tokens that represent ownership of gold. It offers exposure to the price movements of gold without the need for physical ownership.

2. How are digital gold interest rates determined?

🔍 Digital gold interest rates are influenced by various factors, including the current market price of gold, market supply and demand dynamics, and the interest rates set by the platform provider.

3. Can I convert my digital gold holdings into physical gold?

🔍 In some cases, digital gold platforms offer the option to convert digital gold holdings into physical gold. However, this process may involve additional costs and logistical considerations.

4. Are digital gold platforms regulated?

🔍 The regulatory oversight of digital gold platforms varies across jurisdictions. It is important to choose a platform that operates within a regulated framework to ensure investor protection.

5. What is the tax implication of investing in digital gold?

🔍 The tax implications of investing in digital gold differ depending on the country of residence. Investors should consult with tax professionals or relevant authorities to understand their tax obligations.

Conclusion

In conclusion, digital gold interest rates offer investors a convenient and accessible avenue to invest in gold. While it brings advantages such as diversification, accessibility, and fractional ownership, it is important to consider the potential volatility, counterparty risk, and regulatory environment associated with digital gold investments. By conducting thorough research, choosing a reputable platform, and considering personal investment goals and risk tolerance, investors can make informed decisions regarding digital gold interest rates. So, seize this opportunity and take your investment portfolio to new heights!

Final Remarks

Friends, investing in digital gold interest rates can be a rewarding endeavor, but it is crucial to approach it with caution and diligence. Always remember to do your own research, seek professional advice if needed, and stay up-to-date with the latest developments in the market. This article serves as a starting point to help you understand the concept of digital gold interest rates, but it is not intended as financial advice. The decision to invest is solely yours and should be based on your individual financial circumstances and risk tolerance. Good luck on your investment journey!

This post topic: Gold Cryptocurrencies